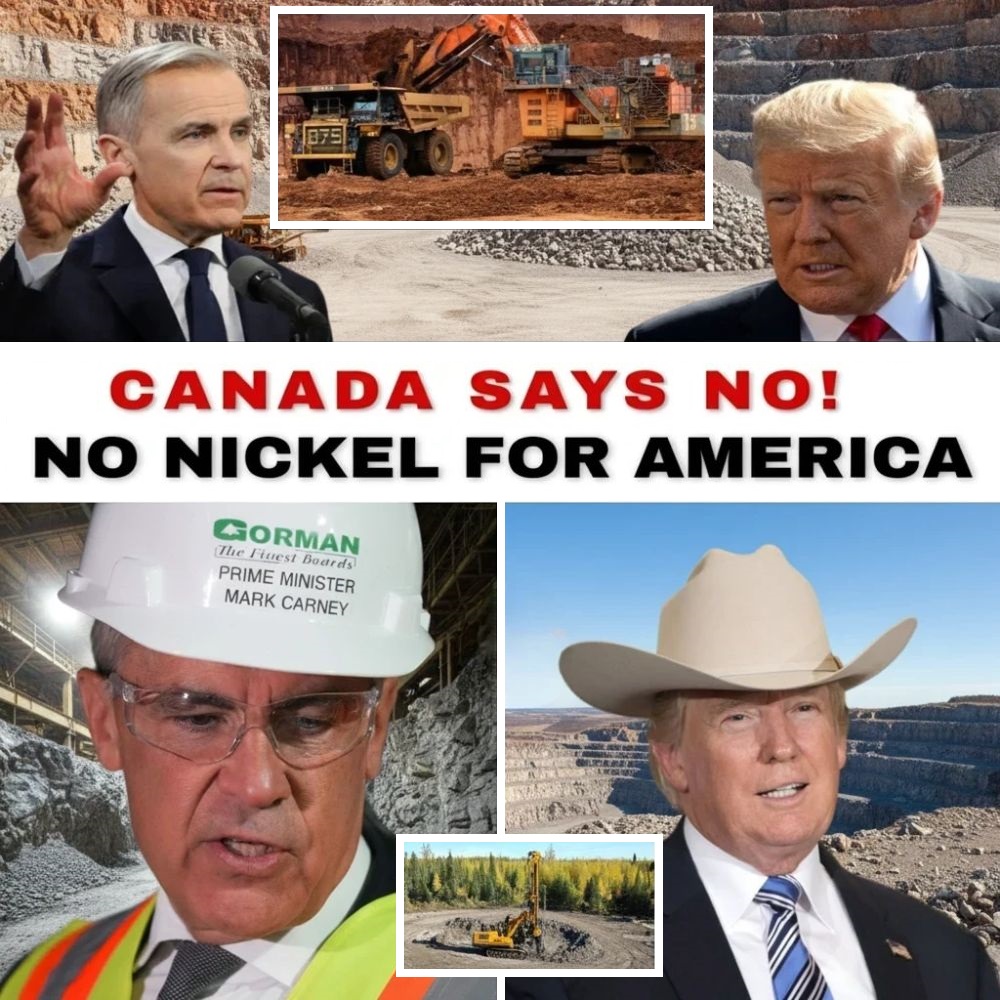

The United States is facing a seismic shift in its economic and environmental landscape as Canada takes control of a critical resource: nickel. This unexpected turn of events, fueled by escalating trade tensions, threatens the future of the U.S. electric vehicle (EV) industry.

President Trump announced a 20% tariff on imported electric vehicles from Canada, a move that has sent shockwaves through North America. This tariff, intended to protect domestic industries, has disrupted a century-long partnership between the two nations, built on mutual prosperity and cooperation.

Canada has long been a reliable supplier of nickel, a crucial component in lithium-ion batteries that power electric vehicles and clean energy systems. With nearly $4 billion worth of nickel flowing into the U.S. annually, the sudden imposition of tariffs has interrupted this vital supply chain.

In response to the tariffs, Canada swiftly implemented strict export controls and taxes on critical minerals, particularly nickel. Shipments that once fueled American battery production are now being redirected to Europe and Asia, where markets offer stable contracts and premium prices for ethically sourced materials.The immediate effects of this trade dispute are palpable. Nickel prices have surged on global markets, creating uncertainty for U.S. battery producers and clean energy companies. Analysts warn that American manufacturers could face significant delays in securing alternative nickel sources, jeopardizing the nation’s clean energy ambitions.

Trump’s administration has publicly accused Canada of unfair trade practices, yet behind closed doors, officials recognize that these tariffs have destabilized the supply chain for a resource essential to the clean energy economy. As Canada strengthens its position, the U.S. finds itself at a disadvantage, with global competitors eager to fill the void. Canada’s investments in high-purity processing plants have transformed it from a mere supplier to a strategic player in the global battery supply chain. By locking in long-term contracts with European and Asian companies, Canada is solidifying its influence over the rapidly evolving clean energy market.

This situation highlights the geopolitical power of controlling critical minerals. Canada’s ability to influence global supply chains grants it leverage in international negotiations, while the U.S. remains vulnerable, heavily reliant on foreign sources of nickel.

The implications extend beyond economics. The U.S. faces immediate and long-term challenges in securing alternative sources of nickel, as mines in other countries often lack environmental oversight and reliable infrastructure. As Canada redirects its resources, the U.S. could experience higher production costs and slower adoption of clean technologies.

This crisis serves as a stark reminder of the shifting dynamics in the global economy. Access to essential resources is now as critical as technological innovation. Canada’s strategic deployment of its nickel resources signals a recalibration of power, with the potential to define industrial and geopolitical dominance in the coming decades.

The United States must respond by diversifying its sources, investing in domestic mining, and negotiating new agreements with Canada. However, the lesson is clear: control over essential materials cannot be taken for granted, and political decisions can lead to far-reaching consequences.

As Canada consolidates its newfound advantage, the balance of power in the critical minerals market has shifted northward. The coming months will determine whether the U.S. can stabilize its EV supply chain or if Canada will continue to define the future of the clean energy economy on its own terms.

In an era increasingly defined by electrification, control over nickel equates to control over the future. Canada is sending a powerful message: it will assert its influence in the global clean energy transition, and the U.S. must adapt or risk falling behind.